Going Concern Assumption Definition, Accounting Principle Explained

Content

- What Are the Assumptions of the Going Concern Concept?

- Qualified opinion

- Amendments under consideration

- Consideration of the Effects on the Auditor’s Report

- When Does a Company Perform a Going Concern Assessment?

- Going Concern Assumption: Fundamental Accrual Accounting Principle

- Examples of Going Concern Concept

- Liquidation Valuation Method (“Fire Sale”)

- How a going concern qualification affects a business

This revaluation may be used to price the company for acquisition or to seek out a private investor. There are often certain accounting measures that must be taken to write down the value of the company on the business’s financial reports. If the accountant believes that an entity may no longer be a going concern, then this brings up the issue of whether its assets are impaired, which may call for the write-down of their carrying amount to their liquidation value. An entity is assumed to be a going concern in the absence of significant information to the contrary. An example of such contrary information is an entity’s inability to meet its obligations as they come due without substantial asset sales or debt restructurings.

What is the opposite of a going concern?

A company that is not a going concern has gone bankrupt and liquidated its assets. The opposite of a going concern or profitable company may also be an unprofitable company.

In May 2014, the Financial Accounting Standards Board determined financial statements should reveal the conditions that support an entity’s substantial doubt that it can continue as a going concern. Statements should also show management’s interpretation of the conditions and management’s future plans. In this situation, Alpha Manufacturing Inc. must disclose this uncertainty in the notes to its financial statements. The disclosure might describe the conditions causing the concern (operating losses, decreased demand, lack of financing), the possible effects (inability to meet obligations, potential bankruptcy), and any plans to mitigate these effects (new financing arrangements, cost reductions, etc.).

What Are the Assumptions of the Going Concern Concept?

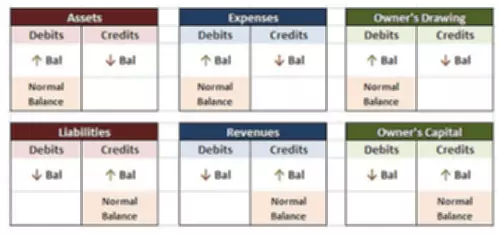

The going concern principle assumes that any organization will continue to operate its business for the foreseeable future. The principle purports that every decision in a company is taken with the objective in mind of running the business rather than that of liquidating it. It’s given when the auditor has doubts about the company and the assumption that it is a going concern. If a company is a going concern, it has no intention to liquidate, so why should it report the current value of its long term assets? Yet, if the value of an asset has been damaged or weakened, then the carrying amount of the asset could be reduced to an amount lower than its carrying value. Thus, companies should make sure they provide sufficient support and documentation to their auditors for key judgments made.

If the auditor determines the plan can be executed and mitigates concerns about the business, then a qualified opinion will not be issued. Accounting principles serve a significant purpose of standardising the way in which businesses perform their financial reporting activities. Accountants who view a company as a going concern generally believe a firm uses its assets wisely and does not have to liquidate anything. Accountants may also employ going concern principles to determine how a company should proceed with any sales of assets, reduction of expenses, or shifts to other products. Ultimately, management should look at going concern assessments as part of normal operations. And while no company wants to find substantial doubt lurking in the shadows, there is a silver lining to all of this – going concern assessments are the canary in the corporate coal mine, the aforementioned operational check engine light.

Qualified opinion

This depreciation calculation is based on the expected economic life of the asset, as opposed to its current market value. Going concern is important because it is a signal of trust about the longevity and future of a company. Without it, business would not offer nearly as much credit sales as suppliers, vendors, and other companies may not pay the company if there is little belief these companies will survive. If a company receives a negative audit and may not be a going concern, there are several implications. Companies that are not a going concern represent a significantly higher level of risk compared to other companies. If there is an issue, the audit firm must qualify its audit report with a statement about the problem.

The auditor’s consideration of disclosure should include the possible effects of such conditions and events, and any mitigating factors, including management’s plans. Under the going concern assumption, an entity is viewed as continuing in business for the foreseeable future. General purpose financial statements are prepared on a going concern basis, unless management either intends to liquidate the entity or to cease operations, or has no realistic alternative but to do so.

Amendments under consideration

Therefore, the term refers to a business that intends to keep operating successfully at least for the next year. In the present year, the management has decided to shut down its export business as continuing the same would only entail in resultant losses and thus not viable. Accordingly, till the previous year IMEXA had prepared its accounts based on the ongoing concern concept, however, this year it shall discard the going concern concept and prepare its accounts on realizable values as it does not foresee doing the business going forward. If the results of the operations of the business enterprise were to be accounted for based on expected liquidation, it would be impossible for suppliers to supply goods and services, for employees to offer their services, and for other businesses to transact with the business entity. Under this concept, it is assumed that the business will operate for a long period of time.

- For a company to be a going concern, it must be able to continue operating long enough to carry out its commitments, obligations, objectives, and so on.

- GAAP is a common set of accounting rules, procedures and standards issued by the Financial Accounting Standards Board (FASB) for financial reporting.

- There are often certain accounting measures that must be taken to write down the value of the company on the business’s financial reports.

- If it’s determined that the business is stable, financial statements are prepared using the going concern basis of accounting.

- Further, since US GAAP doesn’t directly address the topic, a going concern assessment doesn’t affect an entity’s financial accounting, regardless of the assessment results.

- Moreover, relative valuation such as comparable company analysis and precedent transactions value companies based on how similar companies are priced.

By doing so, the auditor is reasonably assured that the business will remain functional during the one-year period stipulated by GAAS. This makes it easy for a parent company to ensure that its subsidiaries are always classified as going concerns. This is especially important for forecasts management uses in the assessment, where a company must design and implement controls appropriately and use complete and accurate data. Likewise, a company must also think about any related controls, including required review controls necessary to complete the assessment. Management teams often confuse intent – especially with external factors outside their control – with feasibility. Like it or not, even the best of intentions have nothing to do with the effectiveness of a mitigation plan.

Consideration of the Effects on the Auditor’s Report

After the auditor has evaluated management’s plans, he concludes whether he has substantial doubt about the entity’s ability to continue as a going concern for a reasonable period of time. If the auditor concludes that substantial doubt does not exist, he should consider the need for disclosure. It may be necessary to obtain additional information about such conditions and events, as well as the appropriate evidential matter to support information that mitigates the auditor’s doubt. Also significant is the fact that if a business is determined to be a going concern that means that it can pay its liabilities and realize its assets.

The going concern assumption essentially says that a company expects to continue operating indefinitely; that is, it expects to realize its assets at the recorded amounts and to extinguish its liabilities in the normal course of business. Exxon Mobil, for example, has existed since 1882, and General Electric has been around since 1892; both of these companies are expected to continue to operate in the future. To assume that an entity will continue to remain in business is fundamental to accounting for publicly held companies. Since we automatically assume that a business is a going concern unless we have evidence to the contrary, it is important to know what types of events might provide evidence that a company is not a going concern. Chapter 7 (liquidation) bankruptcy obviously provides such evidence, as do some other legal proceedings such as seizure to satisfy unpaid taxes or foreclosure on necessary facilities. Businesses sometimes discontinue some of their operations, and in those cases we assume that the operations that were not discontinued constitute a going concern and we simply separate the discontinued operations from the rest of the company.

When Does a Company Perform a Going Concern Assessment?

Any such decisions should be made in consultation with financial advisors or accountants, who can take into account the specifics of the situation and the applicable accounting and auditing standards. Most troubling is that auditors might fail to issue a negative going concern opinion because of the lack https://www.bookstime.com/ of auditor independence. Management determines the auditor’s tenure and remuneration and can hire and fire the auditor at will. The threat of receiving a negative going concern opinion may motivate management to go “opinion shopping,” as was alluded to in the WorldCom and Enron business failures.

Instead, the guidance focuses exclusively on impact and a plan’s ability to address any substantial doubt raised. As another best practice, management must understand that a forecast for going concern should also reconcile with forecast assumptions used in other areas of the company, including asset impairments and income taxes. Aside from those four main items, other obligations may arise that aren’t necessarily contractual, including legal proceedings and any resulting settlements.

Conversely, this means the entity will not be forced to halt operations and liquidate its assets in the near term at what may be very low fire-sale prices. By making this assumption, the accountant is justified in deferring the recognition of certain expenses until a later period, when the entity will presumably still be in business and using its assets in the most effective manner possible. As a best practice, management https://www.bookstime.com/articles/going-concern should start the process early to avoid any surprises on conclusions, especially when there’s a lot of risk and uncertainty around. This early start should include all key stakeholders – accounting, finance, legal, and anyone else involved. It should also include processes to update the assessment for new information as it arises during the subsequent events period but before issuing the financial statements.

- Companies that are not a going concern represent a significantly higher level of risk compared to other companies.

- If the results of the operations of the business enterprise were to be accounted for based on expected liquidation, it would be impossible for suppliers to supply goods and services, for employees to offer their services, and for other businesses to transact with the business entity.

- Thus, companies should make sure they provide sufficient support and documentation to their auditors for key judgments made.

- Since we automatically assume that a business is a going concern unless we have evidence to the contrary, it is important to know what types of events might provide evidence that a company is not a going concern.

- We follow ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

All said and done, the concept is a universally accepted accounting principle that is recognized internationally. The concept requires disclosing the going concern aspect of the business and accordingly account for all the financial transactions from a long term perspective of the business. This concept not only helps in a systematic approach to the recording of the financial transactions but it also provides a fair idea about the business, growth and financial stability of the company. The captioned concept is based on the very assumption that the business will continue to eternity until there is any circumstance that may result in its liquidation.

Examples of Going Concern Concept

Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others. Go a level deeper with us and investigate the potential impacts of climate change on investments like your retirement account. This influences which products we write about and where and how the product appears on a page. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

Seems a little quiet over here

Be the first to comment on this post

Write a response