8 11 Equivalent Units initial period Financial and Managerial Accounting

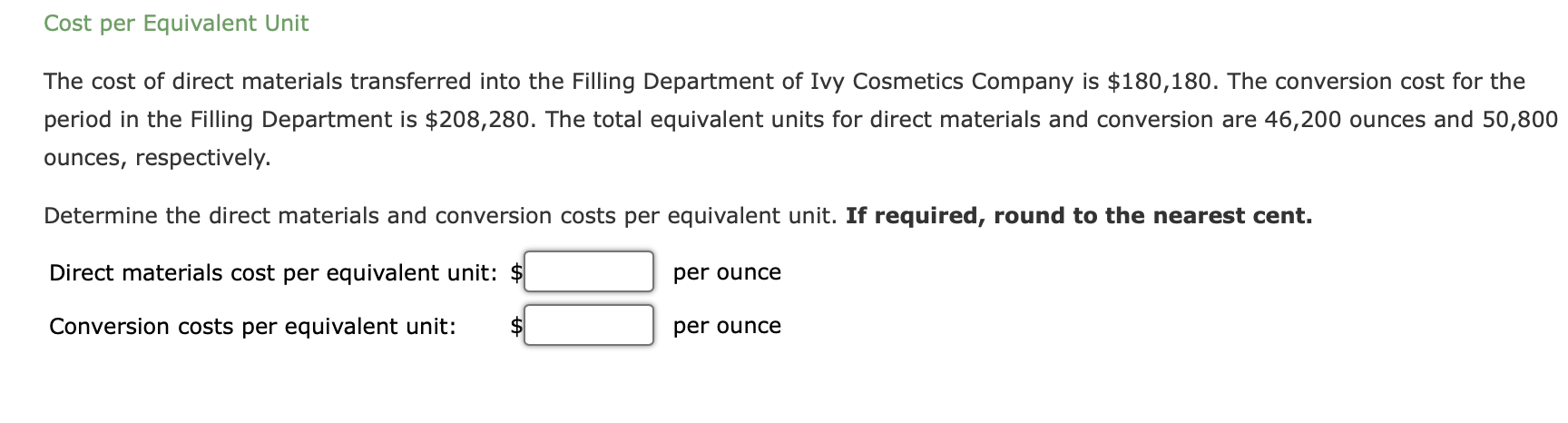

In this case, the equivalent production for opening work-in-progress in the period is 300 units (i.e., 500 x 60%). The treatment of the beginning WIP units will depend on which costing method, usually weighted average or FIFO, the business is using. The problem will provide the information related to beginning work in process inventory costs and units. free income tax calculator 2020 In the next page, we will do a demonstration problem of the FIFO method for process costing. In this example, the Cost Per Equivalent Unit is $7, indicating the cost allocated to each equivalent unit produced. For example, during the month of July, Rock City Percussion purchased raw material inventory of \(\$25,000\) for the shaping department.

Best Practices for Accurate Calculation of Equivalent Units of Production

The total of the 7,500 units completed and transferred out and the 1,200 units in ending inventory equal the 8,700 possible units in the shaping department. The shaping department completed \(7,500\) units and transferred them to the testing and sorting department. No units were lost to spoilage, which consists of any units that are not fit for sale due to breakage or other imperfections.

Accurate financial reporting

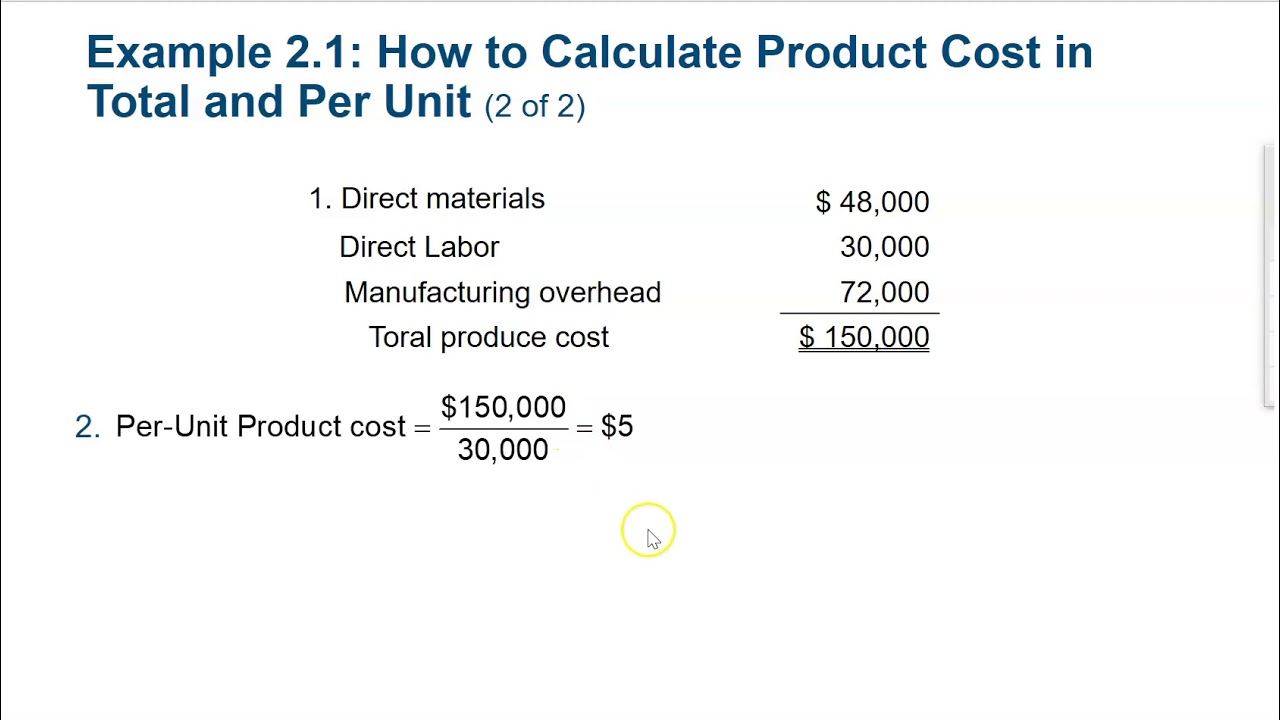

Equivalent Unit of Production (EUP) is a measure used in manufacturing and accounting to determine the total number of fully completed units that could have been produced from work in progress during a given period. In manufacturing, a product typically goes through multiple stages of production, and each stage may produce partially completed units of production that need further processing to become fully completed units. A complete production cost report for the shaping department is illustrated in Figure 5.6. Direct material is added in stages, such as the beginning, middle, or end of the process, while conversion costs are expensed evenly over the process.

Step Four: Allocating the Costs to the Units in the Finishing Department

By using EUP, manufacturers can more accurately track the costs of production, which can help them make more informed decisions about pricing and profitability. EUP can help managers make informed decisions about production, pricing, and business operations. For example, knowing the number of partially completed units can help managers decide which products to prioritize for completion and which ones to delay or discontinue. By calculating EUP, businesses can better manage their inventory levels, as they have a more accurate understanding of the number of units in different stages of production. It can help them avoid overproduction or underproduction, leading to waste or lost sales.

Understanding Equivalent Unit of Production: Definition, How to Calculate and More

The cost to produce a penny is more than one cent, and yet, the United States still makes pennies. See this article from Forbes that explains the difference among cost, worth, and value to learn more. The term “unit of production” refers to a tangible item that a business produces or manufactures, such as a product, part, or component.

What are examples of equivalent units of production?

Units completed and transferred arefinished units and will always be 100% complete for equivalent unitcalculations for direct materials, direct labor and overhead. Forunits in ending work in process, we would take the units unfinishedx a percent complete. The percent complete can be different fordirect materials, direct labor or overhead. For the shaping department, the materials are \(100\%\) complete with regard to materials costs and \(35\%\) complete with regard to conversion costs. The \(7,500\) units completed and transferred out to the finishing department must be \(100\%\) complete with regard to materials and conversion, so they make up \(7,500 (7,500 × 100\%)\) units. The \(1,200\) ending work in process units are \(100\%\) complete with regard to material and have \(1,200 (1,200 × 100%)\) equivalent units for material.

- EUP considers partially completed units in the production process, while actual units produced only consider fully completed units ready for sale or use.

- By calculating the EUP, businesses can accurately estimate their production costs and determine the value of their inventory at different stages of production.

- This can make it challenging to compare equivalent production units across different periods or make accurate forecasts for future production.

For example, a manufacturer may produce 10,000 units of a product, but only 8,000 units are fully completed. The EUP for the 2,000 partially completed units can be calculated to determine the cost per production unit. It requires tracking the units at each production stage and applying conversion factors to determine the equivalent number of completed units.

However, if there are variations in the output quality, this can lead to inaccuracies in calculating equivalent production units. These costs are then used to calculate the equivalent units and total production costs in a four-step process. The limitation of equivalent units computation is that it does not take into account the number of units completed in any specific unit. For example, let’s assume that a company manufactured 2000 motorcycles for this year and 30% of motorcycles were lost due to defects.

The total of the \(6,500\) units completed and transferred out and the \(1,750\) units in ending inventory equal the \(8,250\) possible units in the packaging department. EUP is particularly useful in process costing, where the production process is continuous and involves multiple stages of production. By accurately measuring the EUP, businesses can determine the cost of producing a product over a continuous production process. This helps companies make informed decisions regarding their production processes and allocate resources efficiently. An equivalent unit of production is used in accounting and manufacturing to measure the output of partially completed units of production in terms of fully completed units.

The concept of equivalent units is defined as the number of units that would have been produced given the total amount of manufacturing effort expended for a given period. Now, that may seem obvious, but it’s a point that gets lost when accountants start this analysis. The completed and transferred out units are easier to address than work in process. The physical units can now be represented as equivalent units for each production factor. In this example the weighted average cost method is used and the beginning WIP units are treated as being 100% completed during the period. Equivalent units are calculated by multiply the number of physical units in work in process by the estimated percentage of completion of the units.

In addition to the equivalent units, it is necessary to track the units completed as well as the units remaining in ending inventory. Reconciling the number of units and the costs is part of the process costing system. The reconciliation involves the total of beginning inventory and units started into production.

Seems a little quiet over here

Be the first to comment on this post

Write a response