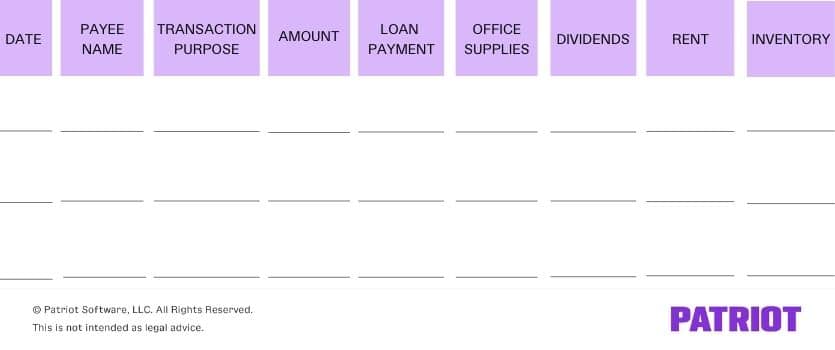

Cash Payment or Cash Disbursement Journal Calculation

Computerized books of accounts use a computer system that automates the accounting process from the journal entries to the ledger balances and the creation of financial statements. The triple-column cash book has three columns and is the most complicated choice of the three. This version has other detailed information, such as purchase or sales discounts, in addition to the information found on the single- and double-column cash books.

Trial Balance

Accurate record-keeping is important for financial reporting and budgeting to keep track of the cash flows. Since the cash disbursements journal also includes the check numbers of any checks that were issued, management can clearly scan the journal for missing or incorrectly written checks. This is why many accounting software packages like Quickbooks tend to call the cash disbursements journal a check register. These are some of the basic information that is usually included in a cash payments journal. There is no standard format, as the journal’s objective is to make further reconciliation and accounting more accessible for the individual. Here, the accounts payable account is debited, and the cash account is credited.

Cash Book vs. Cash Account

- Expenses from the cash disbursements journal are, at the end of each day, posted to the appropriate accounts payable ledger.

- It will ensure accurate record-keeping and simplify analyzing the company’s cash flow.

- On a regular (daily) basis, the line items in the cash disbursement journal are used to update the subsidiary ledgers.

- You should prepare an Affidavit of Loss explaining the valid reason for losing your books of accounts.

- Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

The journal entry is debiting accounts payable $ 2,000 and credit cash on hand $ 2,000. Cash disbursements, or payments from one party to another, are made every day by small businesses to pay for services or goods. Accurately tracking cash disbursements is an essential part of healthy financial management for small businesses, especially in your accounting. Using cloud-based accounting software like Akounto helps to accurately record, organize and maintain the financial records of a business, including a cash disbursement journal. Maintaining accurate records of cash disbursements is crucial for small business owners as it helps them understand their expenses and plan accordingly.

Time Value of Money

No other entry would be made until reimbursement is requested and supported by whatever documentation is needed; then, an entry like the following would be made to summarize all the petty cash transactions. The custodian of the petty cash fund is in charge of approving and making all disbursements from the fund. To create a petty cash fund, a check is written to cash for a set amount such as $75 or $100. A petty cash fund is a small fund whose purpose is to make small disbursements of cash. You should only renew your manual books of accounts after all the pages have been used. The penalties to be imposed for violations regarding the BIR books of accounts can be light or heavy depending upon the kind of violation and the intention of the person making the violation.

Intentional offenses and fraud have more significant penalties and may even include imprisonment. Stamps are provided as proof of the registration of your books of accounts. However, ORUS provides Quick Response (QR) codes as proof of registration instead of traditional stamps.

Computerized Books of Accounts (With a Permit To Use)

Regularly, and in some cases on a daily basis, the line items in the cash disbursement journal are used to update a business’s subsidiary ledgers. If the business’s cash payments are to suppliers for credit purchases, then the subsidiary cash disbursement journal example ledger updated is the accounts payable book. The general ledger contains an accounts payable account, which is your accounts payable control account. The cash disbursements journal has accounts payable credit and debit columns.

Many entrepreneurs start out their small business spending and receiving cash payments. Unlike credit card payments, there is not an automatic system recording each transaction. Besides the above payments, refunds of cash arising from the return of goods by customers are also recorded in the cash disbursements journal. There are additional transactions that need to be recorded for VAT-registered taxpayers.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Seems a little quiet over here

Be the first to comment on this post

Write a response