Free Cash Flow Forecast Templates

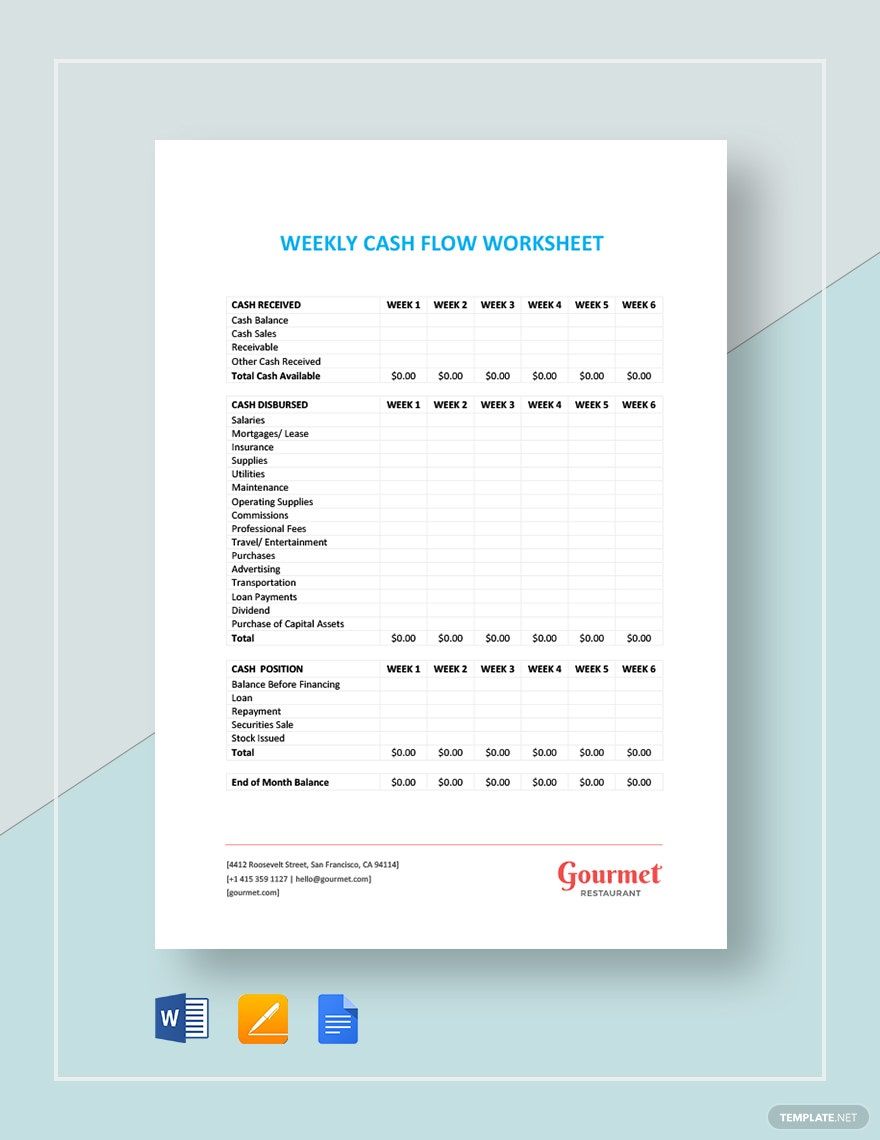

This cash flow statement was designed for the small-business owner looking for an example of how to format a statement of cash flows. If you don’t want to separate the “cash receipts from” and the “cash paid for” then you can just delete the rows containing those labels and reorder the cash flow item descriptions as needed. To perform a cash flow analysis, you can compare the cash flow statement over multiple months or years. You can also use the cash flow analysis to prepare an estimate or plan for future cash flows (i.e. a cash flow budget). This is important because cash flow is about timing – making sure you have money on hand when you need it to pay expenses, buy inventory and other assets, and pay your employees. New businesses trying to secure a loan may also require a cash flow forecast.

Daily Cash Flow Forecast Template

- Delayed payments to employees, suppliers, and other creditors can be massively detrimental to your business, so to understand your cash flow over a certain period of time, you need to create a cash flow statement.

- With the clarity it provides, this productivity tool aids in enhancing your profitability by allowing easy identification of unnecessary expenses and income opportunities.

- Read more about business cash flow, business accounting and Sheetgo’s templates in the articles below.

- IFRS allows dividends and interest paid to be classified as operating or financing activities.

- Cash flow from financing activities can come from receiving financing from investors, issuing payments to shareholders or repaying debt principal.

- The indirect method is slightly more complex as it uses your company’s net income and then calculates depreciation.

Having cash and cash equivalents on your balance sheet shows investors or lenders that your business is financially healthy. If your revenues take a dive, you can still stay on top of your bills and other short-term liabilities. In this cash flow template Google Sheets guide, we will explore various cash flow templates available, highlighting their features.

A Couple Tips for Entering Amounts

To download a version that you can edit and customize, download the spreadsheet below. This Google Sheets Personal Cash Flow Statement Template, adapted from an Excel template by Excel Demy, is a handy tool for managing your personal finances. As a business owner, however, you know you can’t just hope that you’re doing well financially. This template is a basic starting point, so it’s not appropriate for larger businesses who require something more detailed and long-lasting.

Be Aware of the Cash Flow Periods You’re Using

However, IAS 7 requires companies to maintain consistent classification between reporting periods. Companies have the option to consider dividend and interest receipts as investing activities instead. Add in any cash received from the sale of marketable securities, or other investments such as contracts or IP rights.

Getting Started withThis Template

It’s more than a money log sheet; it separates accounts payable and receivable for improved oversight of your company. Of all the tools that businesses can choose from, Google Sheets is already a staple for cash flow management. It offers many advantages like cloud-based data storage and the ability to share data. IFRS requires companies to disclose restricted cash (i.e., inaccessible balances held by the company’s subsidiary) in the cash flow statement. Think of them as standard business activities that generate cash inflows and outflows. This extra step aligns the statement of cash flows with the income statement.

Top 6 best cash flow templates in Google Sheets

However, IAS 7 requires a standard starting point for reporting periods starting January 1, 2027 (read more below). Note that the process is similar to that for calculating the change in operating assets but that the process is reversed. You’ll get bank details for the US, UK, euro area, Australia and New Zealand, to receive fee-free convert from pc to mac payments from these regions. Hold 40+ different currencies, and switch between them using the mid-market exchange rate. Get an immediate download of this template, then access any other templates you’d like in one click. Any articles, templates, or information provided by Smartsheet on the website are for reference only.

If your company can produce cash inflows over the long-term, you can pay for capital expenditures in the future and repay loan balances. In this example, the cash flow statement is prepared using the direct method, which reports the actual cash inflows and outflows from operating activities. This comprehensive template offers an annual overview as well as monthly worksheets. Create a detailed monthly cash flow report to analyze performance or plan for the future. Each month has a separate sheet so that you can get a thorough picture of cash inflows and outflows for both short- and long-term periods. In this post, we have compiled a list of the 17 best free cash flow templates in Google Sheets.

It include sections for an itemized list of revenue and expenditures, automatic calculations of totals and net cash flows, and a simple layout for ease of use. You can modify the template by adding or removing sections to tailor it to your business. Use this income statement template to assess profit and loss over a given time period. This template provides a clear outline of revenue and expenses along with net income figures. You can edit the template to match your needs by adding or removing detail, and create an income statement for a large or small business.

The following Excel spreadsheet provides a template of a typical Cash Flow statement, which may be useful for your small business accounts. On the other hand, minimum payments on credit card balance(s) are included as “Credit Card Payments” in the Debt section of the outflows. Do NOT include the balance in any of the categories listed under “Allocations” in the Outflows section. Because we are treating transfers to these types of savings as Outflows from cash accounts. If you included your Retirement Fund in the cash balance, then it wouldn’t make sense to include “Retirement Fund” as an Outflow.

Seems a little quiet over here

Be the first to comment on this post

Write a response