Break-Even Point Break-Even Analysis Calculator Zoho Inventory

This formula helps you determine the total revenue required to cover your operating expenses, based on your business’s gross margin. If you won’t be able to reach the break-even point based on your current price, you may want to increase it. Increasing the sales price of your items may seem like an impossible task. For many businesses, the answer to both of these questions is yes. Once you calculate your break-even point, you can determine how many products you need to manufacture and sell to make your business profitable.

- When this happens, expect your BEP to increase because of the higher expenses.

- Achieving a competitive price and upgrading the quality of your product will also boost sales, therefore reducing BPE.

- The following table shows current rates for savings accounts, interst bearing checking accounts, CDs, and money market accounts.

- Start ups are exciting, but demand a lot of planning, attention and consistent effort.

- Compare cost, overheads and business factors again return to calculate your break even point when selling multiple items/products.

Contribution Margin Method (or Unit Cost Basis)

From there, you can decide on pricing, production, and sales targets so your business can stay on the right track from the get-go. Break-even analysis looks at internal costs and revenues, but doesn’t factor in external influences that can impact your business. — e.g., changes in market demand, economic conditions, inflation, supply chain disruptions, etc.

What is your current financial priority?

Barbara is the managerial accountant in charge of a large furniture factory’s production lines and supply chains. If you are an Uber driver and you enter for the selling price per unit the average price per trip, then your BEP is the number of trips you must make. The Break-Even point is where your total revenue will become exactly equal to your cost.

Would you prefer to work with a financial professional remotely or in-person?

To address this, consider training and promoting staff into positions with growth. It’s also important to screen and hire quality employees that would help the business thrive. Things such what are some examples of investing activities as retirement, benefit plans, and health care all add up and increase costs by 50%. This gets more expensive the more staff you employ, and the longer you employ certain personnel.

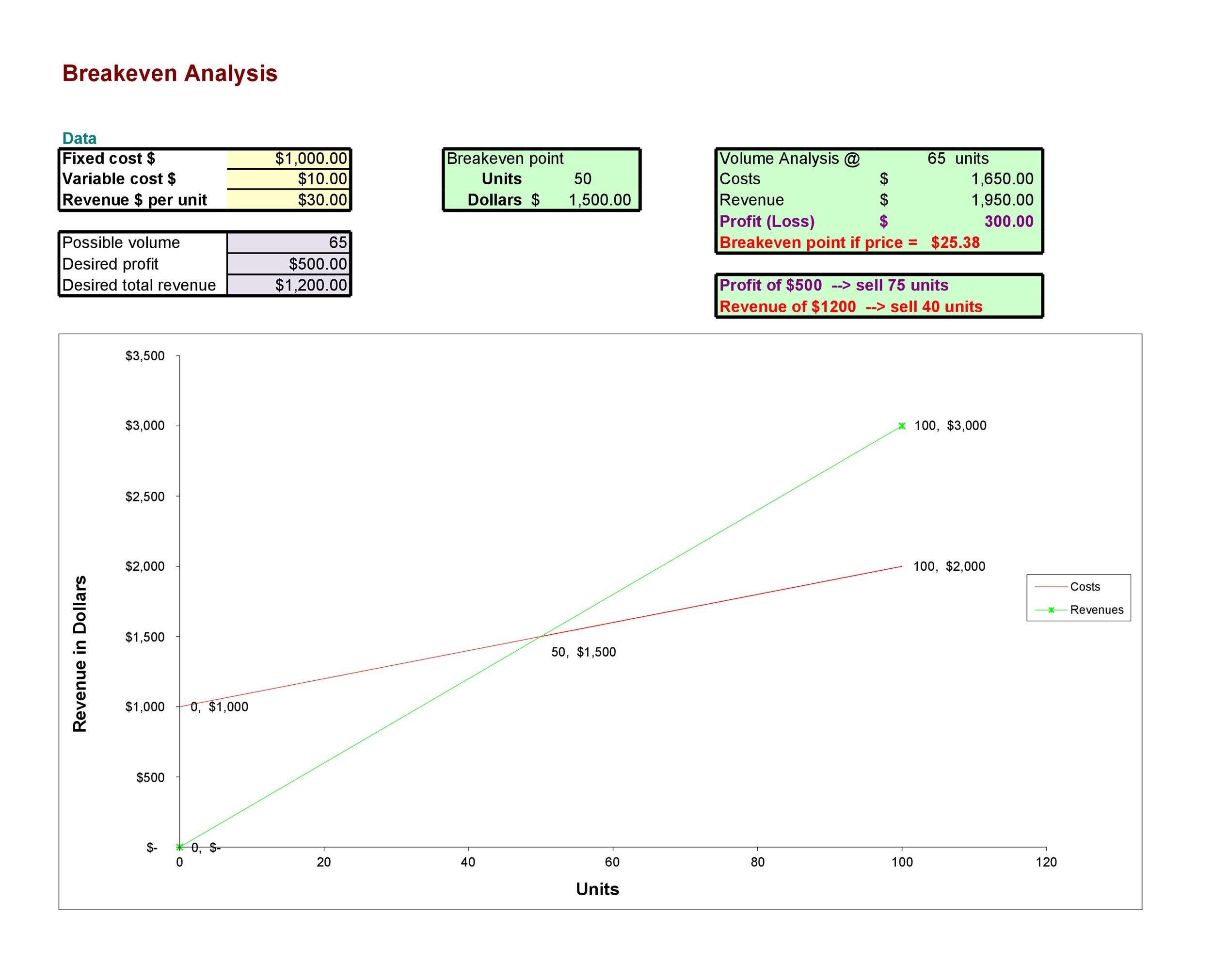

However, it might be too complicated to do the calculation, so you can spare yourself some time and effort by using this Break-even Calculator. All you need to do is provide information about your fixed costs, and your cost and revenue per unit. To make the analysis even more precise, you can input how many units you expect to sell per month.

The fixed costs refer to necessary expenses such as rent or mortgage payments, utilities, marketing, research and development, etc. These are essential operational expenses that keep your business afloat even when you’re not producing goods. Meanwhile, variable costs are expenditures that increase when you raise your production. It includes the cost of raw materials and direct labor needed to produce a product. Generally, the higher the fixed and variable costs of a business, the higher the BPE.

The incremental revenue beyond the break-even point (BEP) contributes toward the accumulation of more profits for the company. There is no net loss or gain at the break-even point (BEP), but the company is now operating at a profit from that point onward. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Launching a new product or service can be exciting but equally intimidating, especially when you’re unsure how much you’ll need to sell to cover your costs. It helps you figure out how many units you need to sell or services you need to provide to make sure your investment pays off. In contrast to fixed costs, variable costs increase (or decrease) based on the number of units sold. If customer demand and sales are higher for the company in a certain period, its variable costs will also move in the same direction and increase (and vice versa). As you can see, the Barbara’s factory will have to sell at least 2,500 units in order to cover it’s fixed and variable costs. Anything it sells after the 2,500 mark will go straight to the CM since the fixed costs are already covered.

Break-even analysis can also be a great way to measure and benchmark your business’s performance over time. Over the past couple of months, you’ve consistently sold 400 units, meaning you’re exceeding your goal and generating profit. On the other hand, if you’re only selling 250 units, you’ll need to either increase sales or lower costs to hit that target. Tracking this data over time can help you identify patterns — e.g., slower sales during specific months — so you can adjust your strategy based on those trends. The formula for calculating the break-even point (BEP) involves taking the total fixed costs and dividing the amount by the contribution margin per unit. Let’s take a look at a few of them as well as an example of how to calculate break-even point.

These are issued by banks and other private lenders, but are guaranteed by the federal government. The SBA offers several different loan programs, such as 504 loans, 7(a) loans, and microloans. Ads and marketing can take a considerable chunk from your revenue. Thus, make sure your campaigns all generate awareness and send the right message to your target market. As a rule, whether you have a large or small budget, you should strategize the most efficient campaign.

Seems a little quiet over here

Be the first to comment on this post

Write a response