What Are Direct Costs? Definition, Examples, and Types

A non-profit organization that runs various programs and activities for its beneficiaries. This organization defines each program or activity as a cost object, and traces the direct costs of staff, volunteers, materials, and travel to each program or activity. It also allocates some indirect costs, such as administration, fundraising, and communication, based on a percentage of the direct costs or a cost driver. The organization uses cost object information to assess the effectiveness and impact of its programs and activities, and to report to its donors and stakeholders.

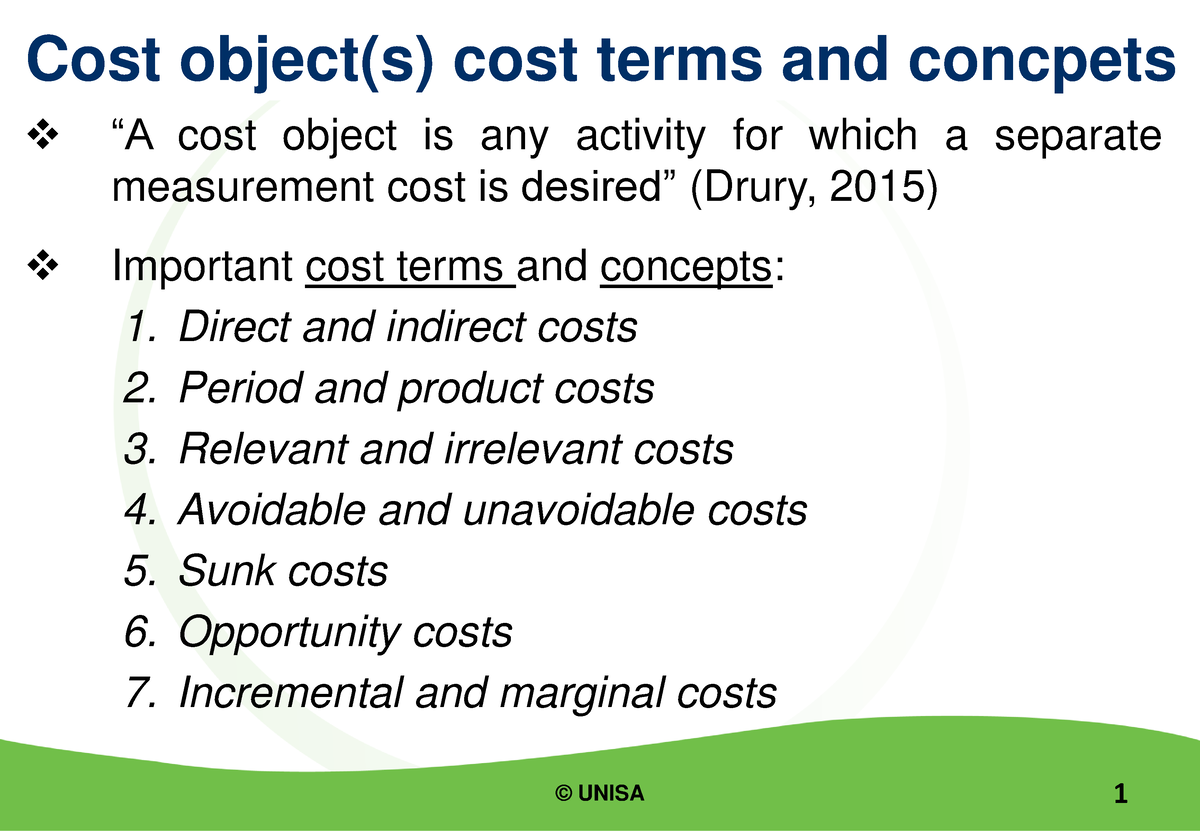

- One of the key concepts in cost accounting is the use of cost objects, which are specific items, products, or activities to which costs can be attributed.

- Below is a break down of subject weightings in the FMVA® financial analyst program.

- In the absence of appropriate direct measurement techniques, indirect costs have to be apportioned to different products.

- “Indirect labor” includes costs for labor that is used in manufacturing but which cannot be directly traced to a specific cost object.

What Are Some Examples of Cost Objects Used in the Manufacturing Industry? – Understanding Cost Objects

However, companies can sometimes tie fixed costs to the units produced in a particular facility. By the end of this section, you should be able to understand the concept of cost object and its implications for managerial accounting. You should also be able to define and trace costs to a specific cost object using various techniques and tools. You should be aware of the benefits and challenges of using cost objects for decision making and performance evaluation. Finally, you should be able to apply the concept of cost object to different scenarios and situations in your own context.

Organization

Cost objects are used by many widely used methods–like activity based costing (ABC)–to allocate direct and direct costs. The most common examples of direct costs include the following expenditures, assuming they are specific to a cost object, such as a product, service, department or project. With the right techniques and best practices, businesses of all sizes can benefit from using cost objects in their accounting and finance practices. By staying up-to-date with the latest trends and practices in cost accounting, companies can ensure that they make informed decisions and maximize their profitability. Direct allocation is the simplest method, assigning costs directly to a specific cost object.

Fixed vs. Variable

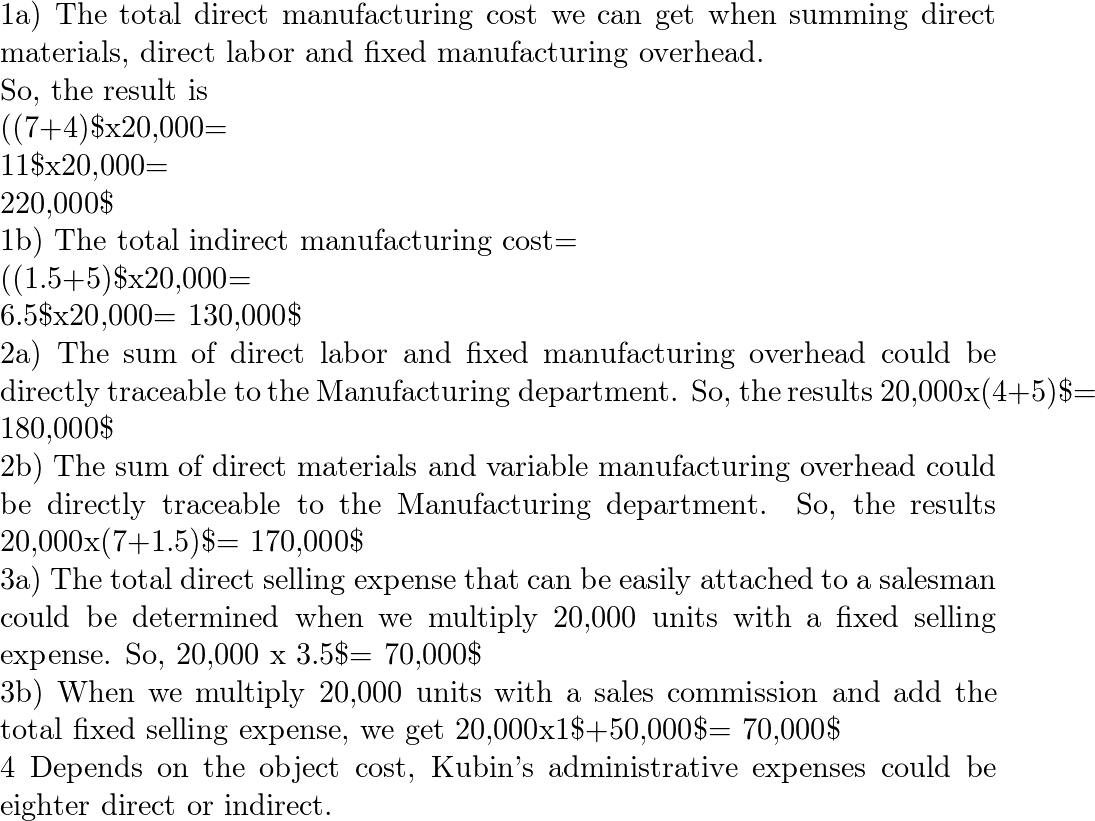

Direct and indirect costs are the major costs involved in the production of a good or service. Although direct costs are typically variable costs, they can also include fixed costs. Rent for a factory, for example, could be tied directly to the production facility.

Direct costs do not need to be fixed in nature, as their unit cost may change over time or depending on the quantity being utilized. This cost may be directly attributed to the project and relates to a fixed dollar amount. Materials that were used to build the product, such as wood or gasoline, might be directly traced but do not contain a fixed dollar amount. This is because the quantity of the supervisor’s salary is known, while the unit production levels are variable based upon sales. From these calculations, we can see that widget A is still more profitable than widget B, but the difference is much smaller than before.

IT managers are responsible for overseeing the organization’s technology systems and infrastructure. They may assign costs to cost objects related to IT expenses, such as software licenses and hardware maintenance. In this blog post, we will explore the definition of cost objects, common types used in business and finance, and their role in cost accounting. Direct costs are easily traceable to the project or product that they are attributed to. It makes direct costs easy to categorize and examine for accountants and business professionals alike. The division manager or department manager will typically not have control over indirect costs.

Larger businesses, on the other hand, may need to use more complex cost allocation methods to assign costs to each cost object accurately. Operating and maintaining specific equipment costs can be tracked using cost objects. By understanding the cost of each piece of equipment, manufacturers can identify how do i request prior year federal tax returns opportunities to improve equipment efficiency, reduce downtime, and optimize maintenance schedules. Businesses may face challenges in choosing the right allocation method when assigning costs to cost objects. Several different allocation methods are available, each with advantages and disadvantages.

If output units are the objects of costing, then direct costs represent costs and resources that can be traced to or identified with the finished product. These costs cannot be avoided and so must be paid even when there is no revenue coming in. Common examples of fixed costs include rent, salaries, insurance, and interest on loans. As businesses strive to reduce their overhead expenses, understanding which costs are fixed and which are variable is essential. This knowledge can help managers make informed decisions about where to cut expenses without adversely affecting production levels or compromising the quality of their products.

With job order costing, costs are assigned to a specific job or order rather than a product or service. For example, a custom furniture manufacturer might use job order costing to track the costs of producing a specific piece of furniture. Manufacturers can also use cost objects to track the cost of materials and services specific suppliers provide. By understanding the cost of each supplier, manufacturers can negotiate better pricing, improve supplier relationships, and reduce supply chain risks. Cost objects can be used to track the cost of individual departments within a manufacturing facility, such as production, engineering, or quality control. By understanding the cost of each department, manufacturers can identify opportunities to reduce costs and improve efficiency.

Seems a little quiet over here

Be the first to comment on this post

Write a response